Excavating the Academia/Policy Pipeline - Economic Analysis at the Bank of England Pre and Post-Crisis

A project funded by Rebuilding Macroeconomics

Table des matières

Project Summary

The Bank of England (BoE) holds a peculiar place among central banks in the Western World. At first glance, it seems more entrepreneurial in the type of research papers it publishes, with strong stances taken on financial regulation (in particular on structural reform of banking), distributional effects of quantitative easing, central bank digital currencies or climate change.

The BoE also fosters methodological innovation, as exemplified by Andy Haldane’s recent interest in agent-based modelling. Yet, it is not clear to what extent the macroeconomic policies it implements, or the macroeconometric models its economists rely on for forecasting, simulation and policy analysis, substantially differ from those implemented in other central banks or taught in departments of economics.

In this project, we combine quantitative analysis, semi-structured interviews and archival evidence to assess the state of the knowledge produced by BoE economists, their background, networks, influences and impact, and to track the historical roots of their underlying modelling culture back into the 1970s to 2010s.

The Project Team

The project involves five other scholars in philosophy, history of economics and political sciences:

- Béatrice Cherrier (Polytechnique Paris, France), the principal investigator of the project;

- Juan Acosta (Universidad de los Andes, Colombia);

- François Claveau (Université de Sherbrooke, Canada);

- Clément Fontan (Université de Saint-Louis et Université Catholique de Louvain, Belgique);

- Francesco Sergi (Université Paris Est Créteil, France).

At different steps of the project, we have received help and technical support from Davide Pulizzotto, Jérémie Dion and Maxime Tremblay.

Quantitative Analysis

We have built two databases for this project.

The first database includes information on the documents published by the Bank of England (BoE) that we have scraped from its website, with typical information such as date, authors, title, but also with the plain text, and, when available, an extraction of the list of references. Among these documents, we have isolated what we consider research documents (working papers and some publications in the Bank Quarterly Bulletin).

The second database contains prosopographic information about BoE economists. In other words, it is a collective biography aiming at uncovering shared characteristics across individuals. Data came from a systematic search in published information about the selected individuals. We have included in the database all the individuals who meet at least one of the two following criteria:

- Having (co-)authored at least 3 Bank of England research documents (academic publications are not counted; see above for the categories of internal research documents);

- Having published at least 1 “discussion paper” between 1979 and 1992. As the Bank counted fewer publications and economists in the 1980s, this was needed to have a larger sample of 1980s BoE economists.

Using these criteria in early 2020 gave us a selection of 368 individuals. The information collected on them include:

- Academic training: the degrees obtained by the individuals, and the place where these degrees were obtained.

- BoE career: the dates of entering and leaving the Bank, the different units (Directorates, Divisions, etc.) the individuals where affiliated to within the BoE, and the period of affiliation to these units.

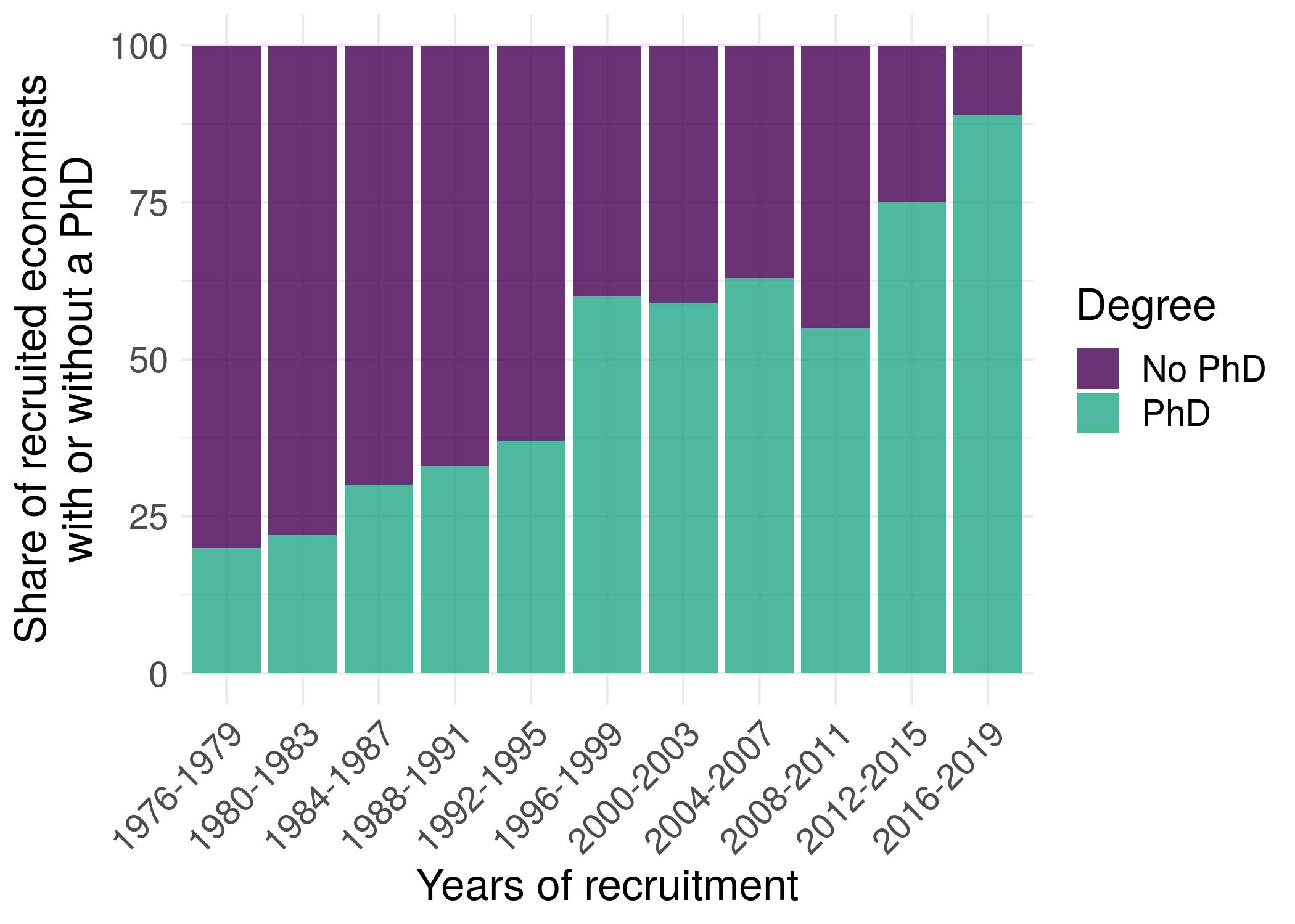

These databases allow us to run different types of quantitative analysis. For instance, the prosopographic database allows us to study the evolution of economists recruitment within the Bank1:

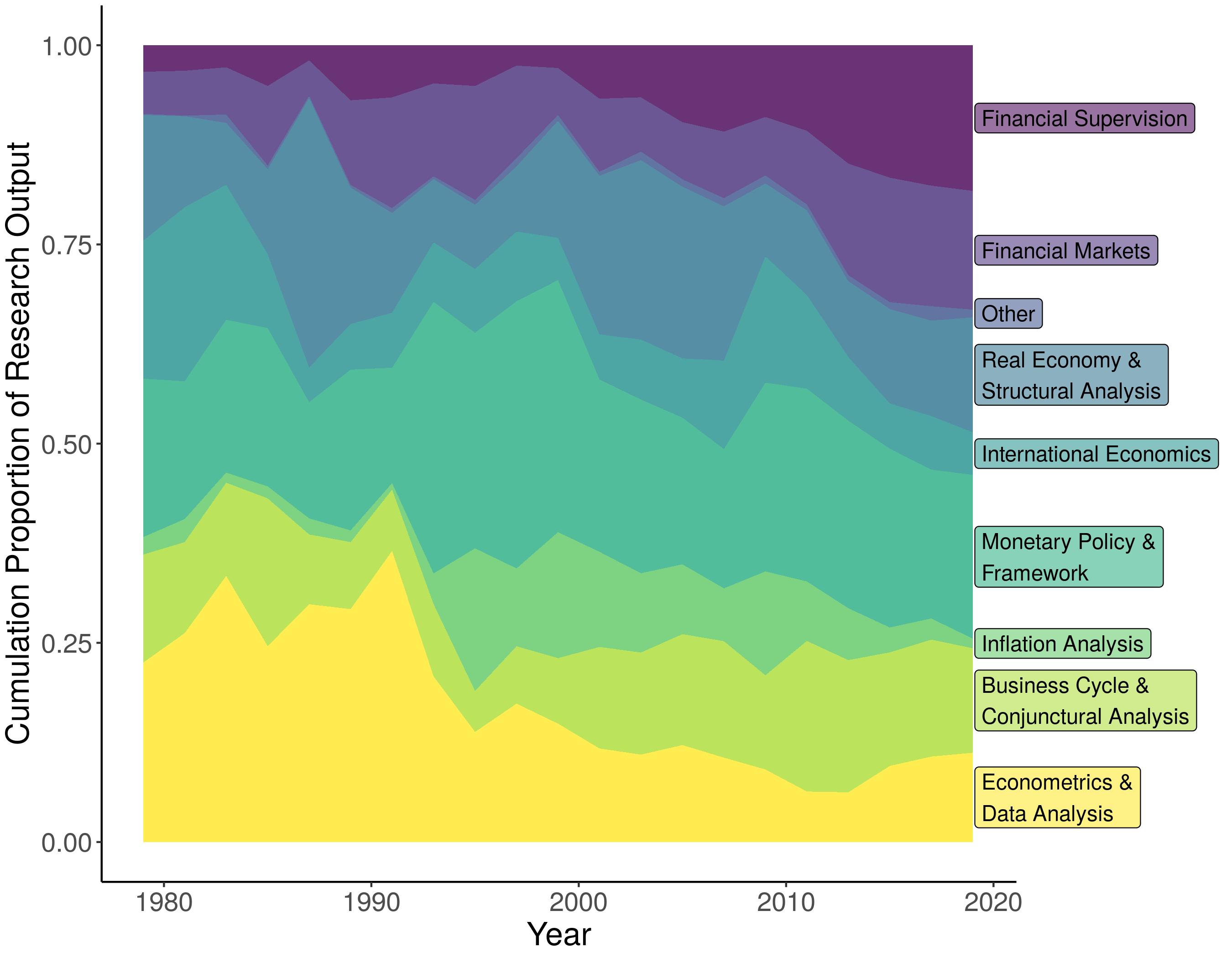

Thanks to the plain text of research publications, extracted in the first database, we have conducted a topic-modelling analysis (run by Davide Pulizzotto). Identifying qualitatively the different topics, we have been able to observe the evolution of the types of topics over time, in the Bank’s research publication:

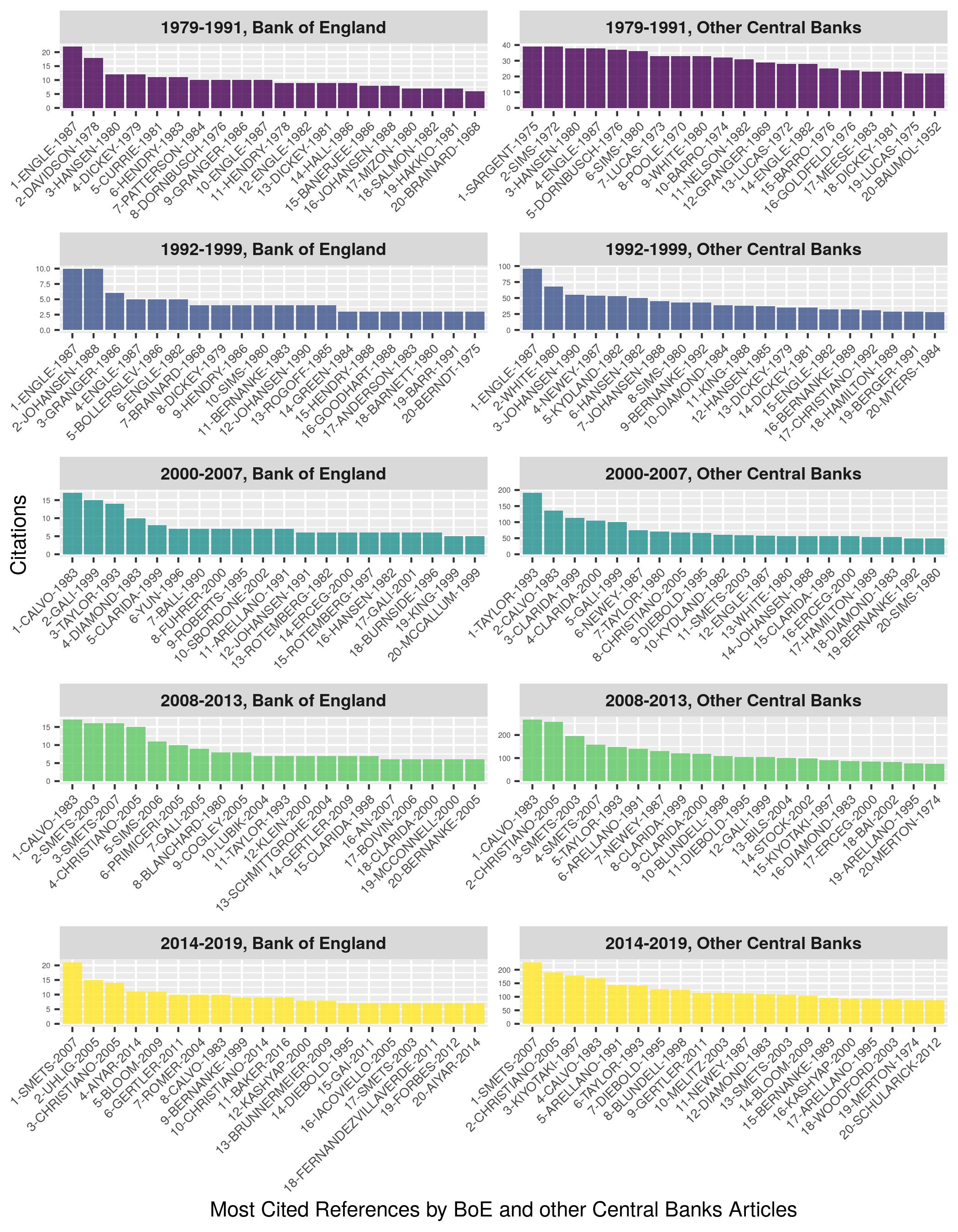

We have also resorted to the Web of Science database to analyse the academic publications of Bank affiliated economists. We have compared the most cited references by Bank’s economists with the references the most cited by other central banks economists:

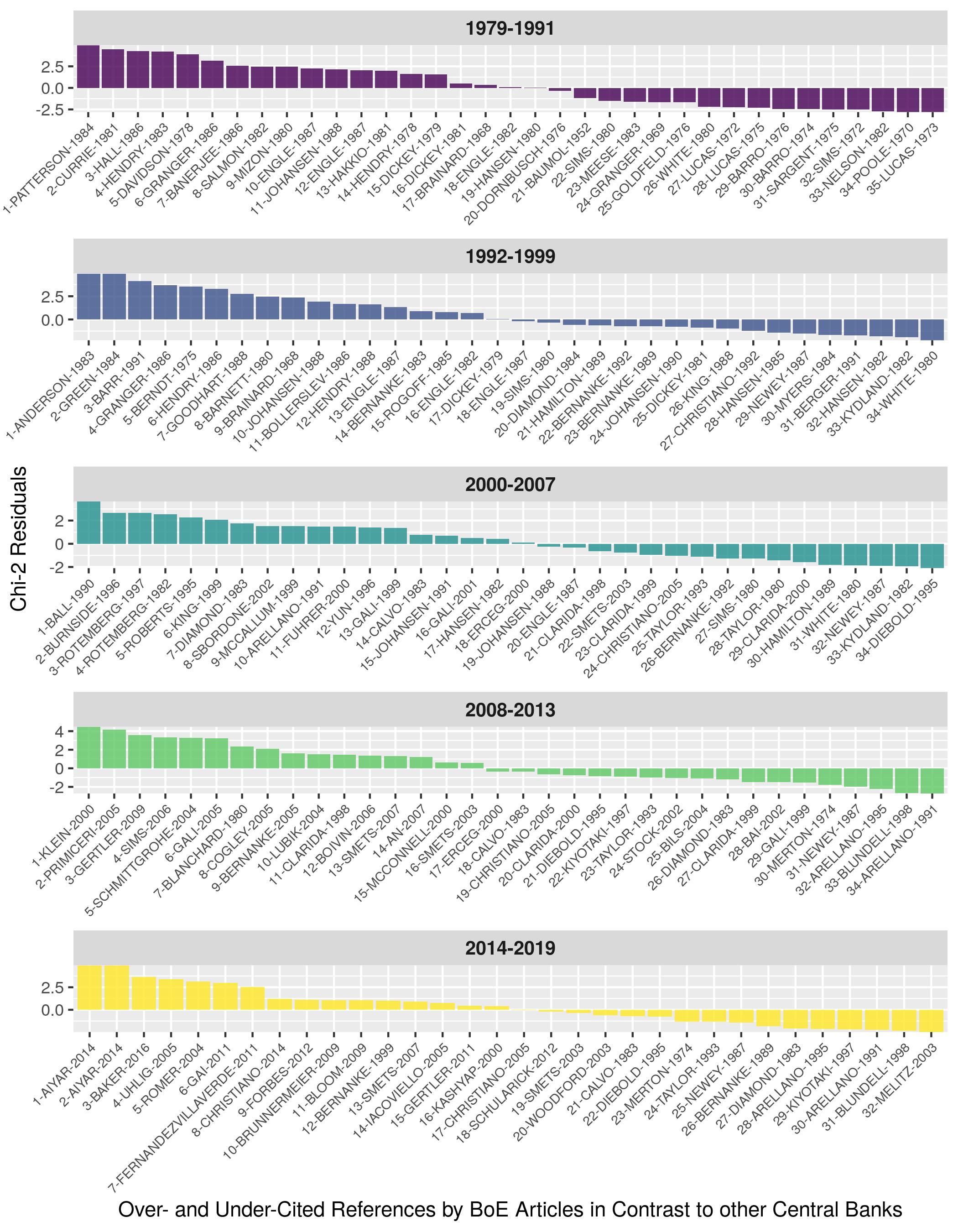

We have then ran a chi-2 test and looked at the residuals to observe which references were over or under-cited by the Bank’s economists:

You can find complementary information on our quantitative analyses here.

Project Outputs

A first working paper has been released in February 2021 (see here). The paper focuses on the transformation of the content, role, and status of economic research at the Bank of England (BoE) since the 1960s. We show how three factors (policy functions and missions of the Bank, its organisational structure, and the attitude of its executives towards economics) shaped the evolution of in-house BoE economic research during three distinctive periods (1960-1991; 1992-2007; 2007-2020).

A second working paper has been released in October 2021 (see here) and has been presented at the HISRECO conference. In this paper, we use as a case study the Bank of England and the different macroeconometric models developed within the Bank until the most recent one (COMPASS). This case study helps us to better understand the constraints to which modellers are submitted.

We are currently working on a third paper, which focuses on the concept of scientisation. It should be presented during the European Society for History of Science (ESHS) conference in september 2022, in a symposium on “Central Banks Scientisation”.

References

Acosta, Juan Carlos, Francois Claveau, Beatrice Cherrier, Clement Fontan, Aurélien Goutsmedt, and Francesco Sergi. 2021. “Six Decades of Economic Research at the Bank of England.” Working Paper.

All the following visualisations are extracted from our first working paper (Acosta et al. 2021). ↩︎